Integrating PayWay Payment Gateway into Your Website or Application

Understanding Payment Gateways: The Backbone of Online Transactions

At its core, a payment gateway acts as a bridge between your website/app and the financial institutions involved in processing transactions. It authorizes payments, ensures security, and manages the flow of funds.

Choosing the Right Payment Gateway: Key Considerations

Selecting the right payment gateway is a critical decision for your business. Here are some factors to weigh:

Security: Robust fraud prevention tools and compliance with industry standards (e.g., PCI DSS) are non-negotiable.

Fees: Transaction fees, setup costs, and monthly charges can vary significantly.

Supported Payment Methods: Ensure the gateway supports the payment methods your customers prefer (e.g., credit cards, direct debit).

Integration Options: Look for a gateway with comprehensive APIs and SDKs to simplify the integration process.

Customer Support: Reliable technical support is crucial in case of issues.

Introduction to PayWay by Westpac

PayWay is a widely-used payment gateway in Australia, offering a range of benefits:

Strong Security: PayWay is PCI DSS compliant and employs advanced fraud detection tools.

Flexible Payment Options: It supports a wide array of payment methods, including credit cards, BPAY, and direct debit.

Integration Capabilities: PayWay provides detailed documentation and APIs for seamless integration with various platforms.

Local Support: As a Westpac product, PayWay offers dedicated Australian-based customer support.

Integrating PayWay: Technical Overview

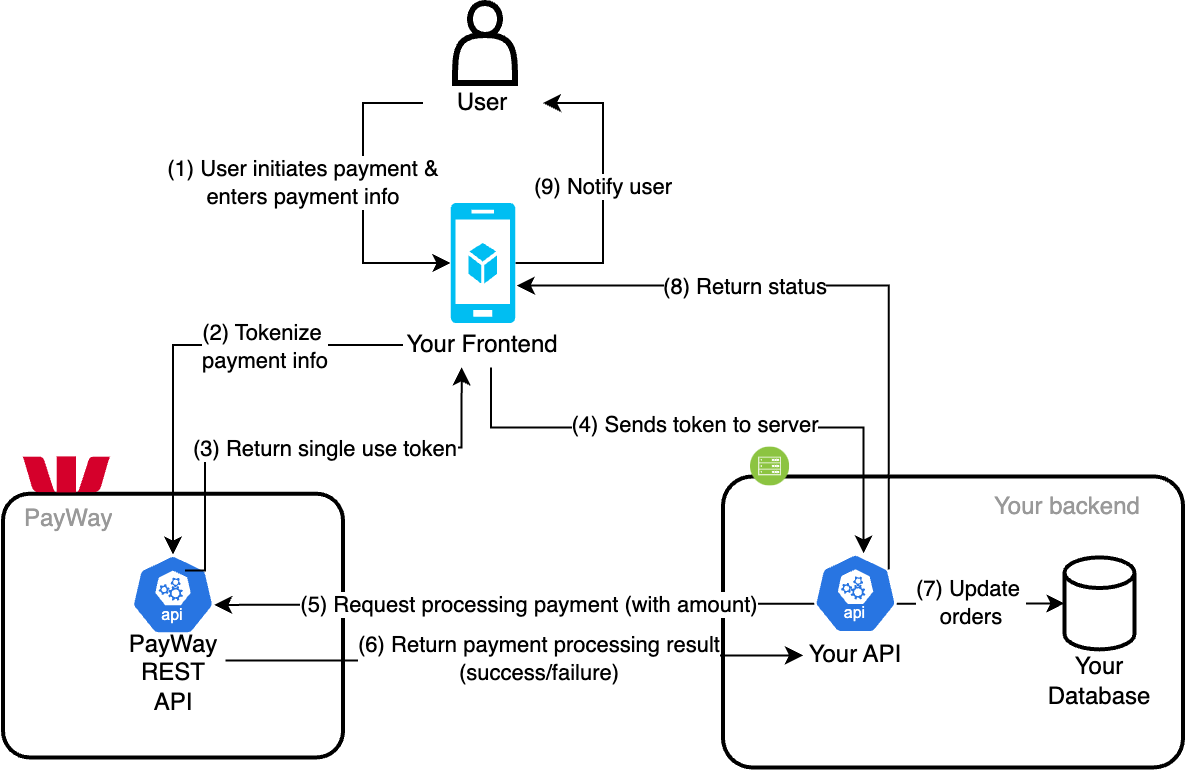

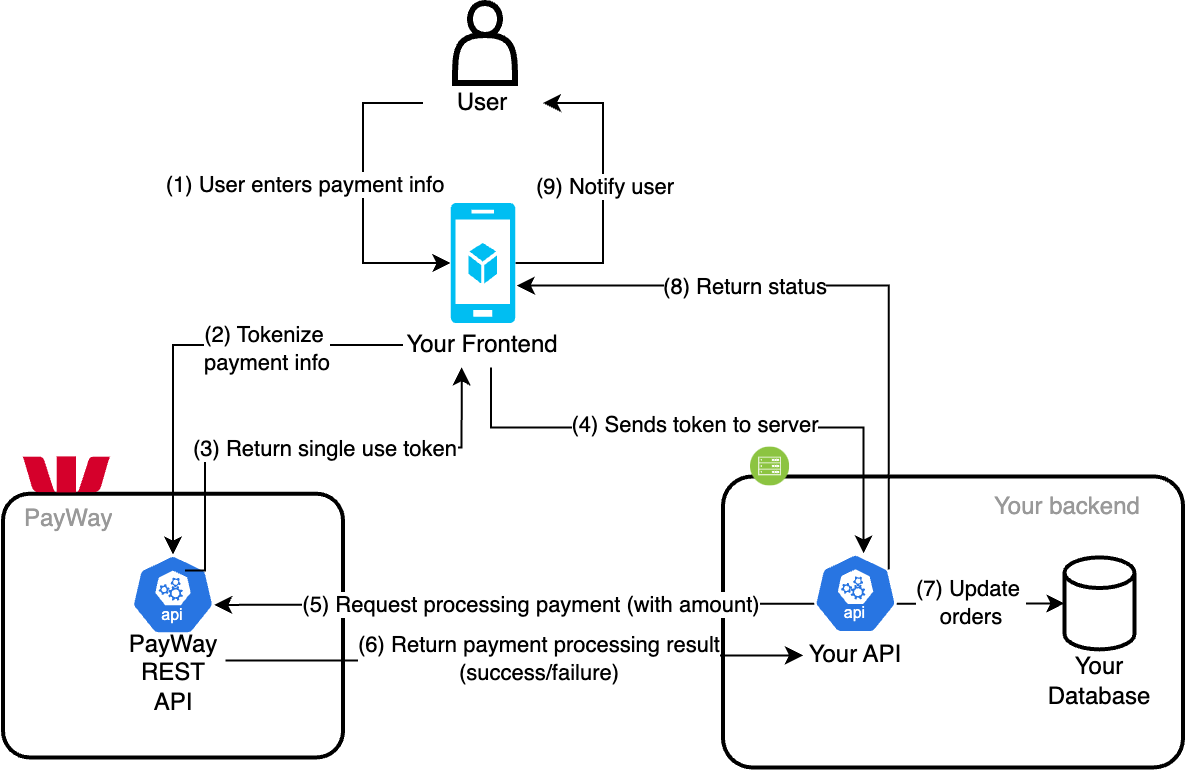

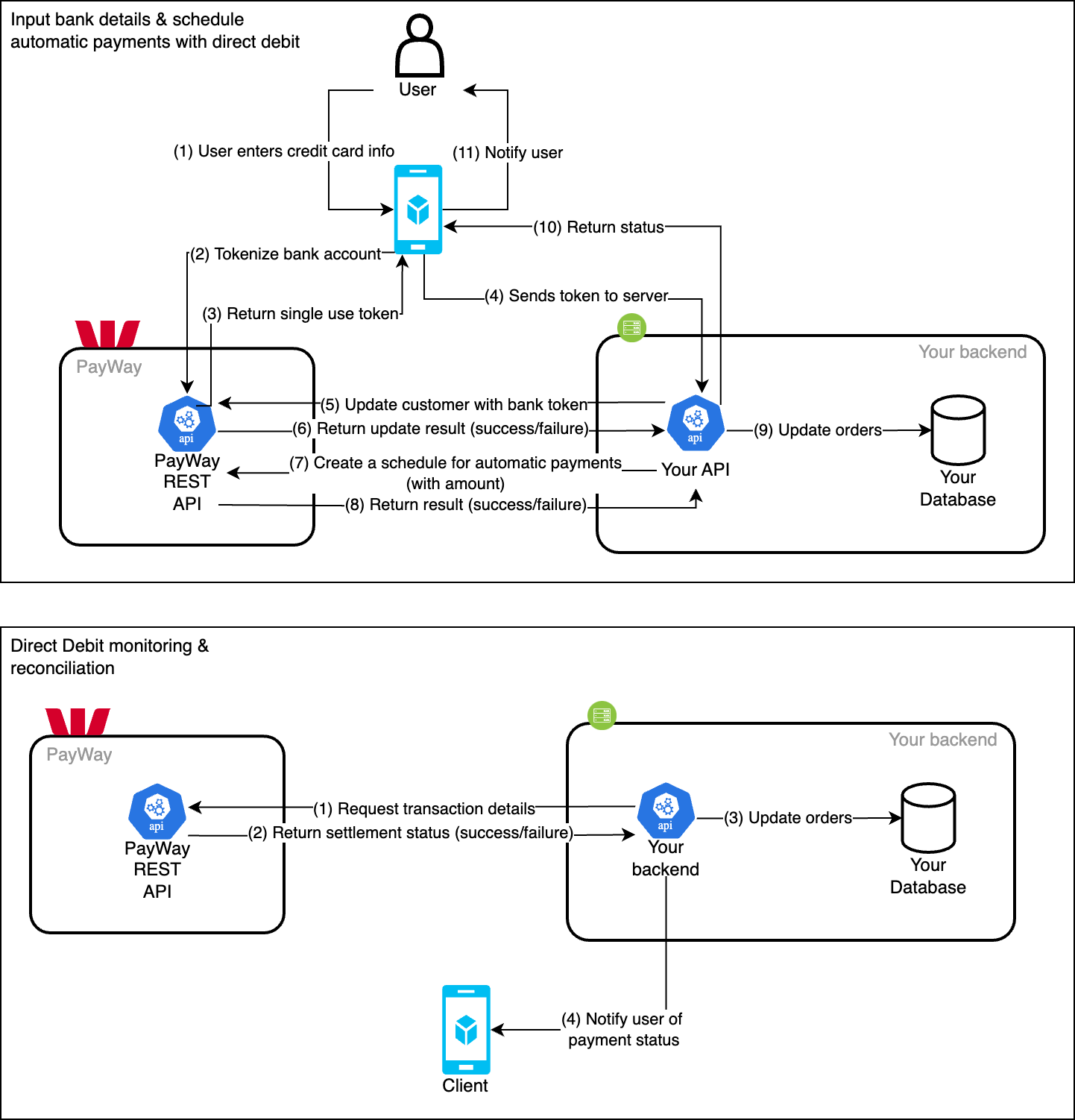

System Architecture

Integrating PayWay into your website or app involves several components working together to process payments securely. Below is a proposed system architecture for integrating PayWay:

Payment Flow

The payment flow for integrating PayWay can be summarized in the following steps:

User Initiates Payment: The user selects a product or service and initiates the payment process on the website or app.

Tokenize Payment Info: The frontend collects the payment information from the user and sends it to the PayWay API for tokenization.

Return Single Use Token: The PayWay API returns a single-use token to the frontend.

Send Token to Server: The frontend sends the token to the backend server.

Request Processing Payment (with amount): The backend server sends a payment request, including the token and the payment amount, to the PayWay API.

Return Payment Processing Result: The PayWay API processes the payment and returns the result (success or failure) to the backend server.

Update Orders: The backend server updates the order status in the database based on the payment processing result received from the PayWay API.

Return Status: The backend server responds to the frontend with the payment status.

Notify User: The frontend notifies the user of the payment status, showing a confirmation message on the website or app.

Practical Example: Integrating PayWay in Python

To demonstrate how to integrate PayWay into your application, we made a proof of concept (POC) code available on our GitHub repo.

This POC provides examples for processing credit card and direct debit payments using PayWay.

The code implementations are for demonstration purposes only and should be adapted to your specific requirements and security standards.

Credit Card Payment Example

Here is a simplified version of how to process a credit card payment using PayWay:

import requests

PAYWAY_API_URL = "https://api.payway.com.au/rest/v1/transactions"

PAYWAY_SINGLE_USE_TOKEN_API_URL = "https://api.payway.com.au/rest/v1/single-use-tokens"

PAYWAY_PUBLISHABLE_API_KEY = "" <-- This should be your publishable key

PAYWAY_SECRET_API_KEY = "" <-- This should be your secret key

def process_credit_card_payment(amount, card_number, card_holder_name, expiry_month, expiry_year, cvn, merchant_id="TEST"):

# Tokenize card information

# Should be using payway.js with trusted frame to tokenize card information

# or calling the single use token endpoint directly from your frontend using publishable key

card_info_data = {

"paymentMethod": "creditCard",

"cardNumber": card_number,

"cardholderName": card_holder_name,

"cvn": cvn,

"expiryDateMonth": expiry_month,

"expiryDateYear": expiry_year,

}

tokenizing_response = requests.post(

PAYWAY_SINGLE_USE_TOKEN_API_URL,

data=card_info_data,

headers={

"Content-Type": "application/x-www-form-urlencoded",

},

auth=(PAYWAY_PUBLISHABLE_API_KEY, "")

)

token = tokenizing_response.json()["singleUseTokenId"]

# Process payment

payment_data = {

"transactionType": "payment",

"singleUseTokenId": token,

"customerNumber": "your_customer_number",

"principalAmount": amount,

"currency": "aud",

"merchantId": merchant_id,

}

response = requests.post(

PAYWAY_API_URL,

data=payment_data,

headers={

"Content-Type": "application/x-www-form-urlencoded",

},

auth=(PAYWAY_SECRET_API_KEY, "")

)

if response.status_code != 200:

raise Exception("the payment was not successful")

return response.json()

# Example usage

response = process_credit_card_payment(1000, "4111111111111111", "John Doe", "12", "25", "123")

print(response)Direct Debit Payment Example

Similarly, here is an example for processing a direct debit payment:

from datetime import datetime

import requests

PAYWAY_API_URL = "https://api.payway.com.au/rest/v1/transactions"

PAYWAY_SINGLE_USE_TOKEN_API_URL = "https://api.payway.com.au/rest/v1/single-use-tokens"

PAYWAY_CUSTOMER_API_URL = "https://api.payway.com.au/rest/v1/customers/{customer_id}"

PAYWAY_REGULAR_PAYMENT_API_URL = "https://api.payway.com.au/rest/v1/customers/{customer_id}/schedule"

BANK_ID = "0000000A"

PAYWAY_PUBLISHABLE_API_KEY = "" <-- This should be your publishable key

PAYWAY_SECRET_API_KEY = "" <-- This should be your secret key

def process_direct_debit_payment(amount, frequency, bsb, account_number, account_name, customer_id, merchant_id="TEST"):

# Tokenize card information

# Should be using payway.js with trusted frame to tokenize card information

# or calling the single use token endpoint directly from your frontend using publishable key

card_info_data = {

"paymentMethod": "bankAccount",

"bsb": bsb,

"accountNumber": account_number,

"accountName": account_name,

}

tokenizing_response = requests.post(

PAYWAY_SINGLE_USE_TOKEN_API_URL,

data=card_info_data,

headers={

"Content-Type": "application/x-www-form-urlencoded",

},

auth=(PAYWAY_PUBLISHABLE_API_KEY, "")

)

token = tokenizing_response.json()["singleUseTokenId"]

# Store the bank account to customer

customer_data = {

"singleUseTokenId": token,

"merchantId": merchant_id,

"bankAccountId": BANK_ID

}

customer_response = requests.put(

PAYWAY_CUSTOMER_API_URL.format(customer_id=customer_id),

data=customer_data,

headers={

"Content-Type": "application/x-www-form-urlencoded",

},

auth=(PAYWAY_SECRET_API_KEY, "")

)

# Set a schedule payment for the stored customer

payment_data = {

"frequency": frequency,

"nextPaymentDate": datetime.today().strftime('%d %b %Y'),

"regularPrincipalAmount": amount,

}

response = requests.put(

PAYWAY_REGULAR_PAYMENT_API_URL.format(customer_id=customer_id),

data=payment_data,

headers={

"Content-Type": "application/x-www-form-urlencoded",

},

auth=(PAYWAY_SECRET_API_KEY, "")

)

if response.status_code != 200:

raise Exception("the payment was not successful")

return response.json()

# Example usage

response = process_direct_debit_payment(1000, "weekly", "012003", "456789", "John Doe", "your_customer_number")

print(response)Settlement & Reconciliation

Settlement involves transferring funds from the customer’s bank account to the merchant’s account, typically through batch processing, clearing, and funding stages. Reconciliation ensures all transactions are accurately recorded, matching payment gateway records with bank statements to identify discrepancies such as failed transactions, chargebacks, or duplicate payments.

For direct debit and credit card payments, common errors include insufficient funds, invalid details, or authorization failures. Handling these errors involves notifying customers promptly, retrying transactions if supported, and maintaining detailed records to resolve disputes effectively.

Handling errors

For direct debit, handle issues like insufficient funds by notifying customers and retrying payments.

For credit card payments, ensure real-time validation and provide clear error messages for failures due to invalid or expired cards. Implement robust error handling and automated reconciliation tools to streamline the process, reducing manual errors and enhancing customer satisfaction.

Regular monitoring and communication with customers about transaction statuses are crucial for maintaining trust and ensuring smooth payment processing.

Example PayWay SDK

The codes we introduced above were the simplified version of how you could communicate with PayWay using Python's requests library. While this approach works, it requires manual handling of HTTP requests and responses, which can be error-prone and time-consuming.

The better approach is to implement an SDK. We've developed an example SDK client that abstracts away the complexities of direct API calls. Using SDK client, you can enjoy several benefits:

Ease of Use: The SDK provides intuitive functions that simplify interactions with the PayWay API, reducing boilerplate code and making your codebase cleaner.

Improved Reliability: Our SDK handles many common issues such as retries, error handling, and response parsing, ensuring more reliable and robust communication with the PayWay API.

Enhanced Security: By managing authentication and secure data transmission within the SDK, we minimize potential security vulnerabilities in your application.

You can integrate this SDK into your project by visiting our GitHub repo. The repository includes comprehensive examples to help you get started quickly.

SDK Usage Example: Credit Card Payment

Here's an example of how you can use our example PayWay SDK to process a credit card payment.

Please note that this is for demonstration purposes only, and not an official SDK from PayWay, hence you should adapt it to your specific requirements and security standards.

Create a PayWay client instance:

payway_client = PayWayClient(

api_base_url="https://api.payway.com.au/rest/v1",

merchant_id="TEST",

bank_account_id="0000000A",

publishable_api_key="YOUR_PUBLISHABLE_API_KEY",

secret_api_key="YOUR_SECRET_API_KEY",

)

Create a customer and store the card token:

# Create a customer instance

customer = PayWayCustomer(

custom_id="[YOUR_CUSTOMER_ID]",

customer_name="John Doe",

email_address="johndoe@whitefox.cloud",

send_email_receipts=False,

phone_number="0343232323",

street="1 Test Street",

street2="2 Test Street",

city_name="Melbourne",

state="VIC",

postal_code="3000",

token=token,

)

# Store the customer information with the card

payway_customer, errors = payway_client.create_customer(customer)

if errors:

for error in errors:

print(error.to_message())

return

# Log customer creation information

print("Created customer:", payway_customer.customer_number)Process a transaction:

# Create a transaction instance

payment = PayWayPayment(

customer_number=payway_customer.customer_number,

transaction_type="payment",

amount="YOUR_AMOUNT",

currency="aud",

order_number="YOUR_ORDER_NUMBER",

ip_address=""

)

# Process the payment transaction

transaction, errors = payway_client.process_payment(payment)

if errors:

for error in errors:

print(error.to_message())

return

# Log transaction information

print("Processed transaction:", transaction.transaction_id)

print("Transaction status:", transaction.statusThis example demonstrates how you can use the PayWay SDK to handle credit card payments in a more structured and secure manner.

You can get started using our example SDK code. If you need further assistance or customization, feel free to reach out to us. We can help you tailor the SDK to your specific requirements and ensure a seamless integration with PayWay.

Comparing PayWay with Monoova, Stripe, and Other Australian Payment Gateways

| Feature | PayWay | Monoova | Stripe | Zepto | Azupay | eWAY | Braintree |

|---|---|---|---|---|---|---|---|

| Security | PCI DSS Compliant | PCI DSS Compliant | PCI DSS Compliant | PCI DSS Compliant | PCI DSS Compliant | PCI DSS Compliant | PCI DSS Compliant |

| Payment Methods | Credit cards, BPAY, Direct Debit | Credit cards, PayTo, Direct Debit, PayID, NPP | Credit cards, digital wallets, etc. | PayID, NPP, Direct Debit | PayID, NPP | Credit cards, PayPal | Credit cards, PayPal |

| Generating virtual accounts on-demand | Yes | Yes | No | Yes | Yes | No | No |

| Integration | API, Hosted Page, etc. | API, SDK | API, SDK, Pre-built UI | API, SDK | API, SDK | API, SDK | API, SDK |

| Customer Support | Australian-based | Australian-based | Global, 24/7 | Australian-based | Australian-based | Australian-based | Global |

| Additional Features | Limited | Real-time payments, PayTo, automated reconciliation with PayID | Recurring billing, marketplace, etc. | Automated reconciliation | PayTo, Auto-matching transactions |

Alternative solution: Monoova

While PayWay is a popular choice, it's important to consider alternatives like Monoova. Monoova is known for its focus on real-time payments and innovative features like PayTo.

Security

Monoova does comply with the PCI DSS Compliant, providing strong security measures.

Payment Methods

Monoova supports more payment methods than PayWay. It specializes in real-time payments, including PayTo, PayID and NPP (New Payments Platform) payments.

Virtual Accounts & PayID

Generating virtual accounts on-demand

Monoova allows generating virtual BSB and account numbers on-demand, providing flexibility for businesses to manage their payments.

PayID

PayID is a unique identifier that can be linked to a bank account, a feature that enables customers to make payments with easy-to-remember information. Instead of providing a BSB and account number, users can provide a simple identifier such as a phone number, email address, or ABN. This makes the payment process more convenient and secure.

With Monoova, you can generate/assign PayIDs and unique account numbers to every single one of your customers.

Automated reconciliation

It offers automated reconciliation with PayID, which simplifies the process of matching incoming payments to invoices or customer accounts. This feature reduces the manual effort required for reconciliation, enhances accuracy, and helps in maintaining up-to-date financial records.

Integration

Monoova offers comprehensive documentation and various integration options, making it suitable for a wide range of businesses. It also provides APIs that are designed for seamless integration with modern financial systems.

Pricing

It offers competitive pricing with a focus on high-volume, real-time transactions.

Whitefox Expertise: Your Partner in Payment Gateway Integration

Integrating a payment gateway is a crucial step in transforming your website or app into a powerful sales channel. With a carefully chosen gateway and expert implementation, you can offer your customers a secure, convenient payment experience, leading to increased sales and customer satisfaction.

Navigating the technical complexities of payment gateway integration can be daunting. Whitefox can guide you through the process, from selecting the optimal gateway to ensuring a seamless integration with proper testing.

If you need assistance with integration or have any questions, feel free to reach out to Whitefox.

Streamline Your FHIR Implementation with Our Free Tools